Futures trading offers a diverse array of opportunities for investors seeking to capitalize on price movements across various asset classes. The profitability of futures trading is influenced by factors such as market conditions, economic trends, and geopolitical events. In this exploration of profitable futures trading, we will delve into some of the most lucrative futures markets, examining the characteristics that make them attractive to traders and investors.

Energy Futures: Capitalizing on Volatility

Energy futures, particularly those tied to commodities like crude oil and natural gas, are renowned for their potential profitability. The energy sector is characterized by significant price volatility influenced by geopolitical tensions, supply-demand dynamics, and global economic conditions. Traders and investors who can navigate and anticipate these factors may find lucrative opportunities in energy futures markets. Crude oil futures, for example, often respond sharply to geopolitical events, making them attractive for those seeking profit potential in times of heightened uncertainty.

Agricultural Futures: Harvesting Profits from Supply and Demand

Agricultural futures present another avenue for profitable trading, as they are influenced by factors such as weather patterns, crop yields, and global food demand. Commodities like soybeans, corn, wheat, and coffee are actively traded in futures markets. Traders who closely monitor agricultural trends, seasonal patterns, and supply chain dynamics may identify profitable opportunities in response to shifts in supply and demand. For instance, a poor harvest due to adverse weather conditions can lead to a decrease in supply, potentially driving up prices and creating profitable scenarios for futures traders.

Precious Metals Futures: Seeking Safe-Haven Returns

Investors often turn to precious metals futures, including gold and silver, as safe-haven assets during times of economic uncertainty. These metals have historically served as stores of value and hedges against inflation. Gold futures, in particular, attract traders looking for a haven amid market turbulence. Profitable opportunities may arise when economic indicators signal instability, prompting investors to seek refuge in precious metals. Understanding the relationship between economic conditions and the demand for safe-haven assets is crucial for successfully trading precious metals futures.

See Also: What is the best futures trading strategy?

Currency Futures: Navigating the Forex Markets

Currency futures, representing contracts tied to exchange rates between different currencies, offer profit potential in the foreign exchange (forex) markets. Traders can capitalize on fluctuations in currency values, influenced by macroeconomic indicators, central bank policies, and geopolitical developments. Popular currency futures include contracts tied to major pairs like EUR/USD, GBP/USD, and USD/JPY. Profitable opportunities in currency futures trading often require a deep understanding of global economic trends, interest rate differentials, and geopolitical factors influencing currency movements.

Index Futures: Riding the Waves of Market Indices

Index futures, linked to the performance of stock market indices, provide traders with opportunities to profit from broad market movements. Contracts tied to indices like the S&P 500, Nasdaq-100, and Dow Jones Industrial Average are widely traded. Profits in index futures can be achieved through both bullish and bearish strategies, allowing traders to capitalize on market trends in either direction. Successful trading in index futures requires a keen understanding of market sentiment, technical analysis, and the factors influencing specific sectors within the broader market.

Interest Rate Futures: Navigating Changes in Monetary Policy

Interest rate futures are tied to the yields on government bonds and represent expectations regarding future interest rate movements. Central bank policies, economic data releases, and inflation expectations influence interest rate futures. Traders may find profitable opportunities by anticipating changes in monetary policy, such as interest rate hikes or cuts. For example, when interest rates are expected to rise, traders may take positions in interest rate futures to benefit from potential yield increases. Monitoring economic indicators and central bank communications is crucial for successful trading in interest rate futures.

Cryptocurrency Futures: Exploring the Digital Frontier

The emergence of cryptocurrency futures has introduced a new dimension to profitable trading. Futures contracts linked to cryptocurrencies like Bitcoin and Ethereum allow traders to speculate on digital asset prices. The cryptocurrency market is known for its volatility, creating opportunities for significant profits. Traders should be aware that the cryptocurrency landscape is relatively young and can be influenced by factors such as regulatory developments, technological advancements, and market sentiment. While the potential for high returns exists, trading cryptocurrency futures requires a thorough understanding of the unique dynamics of the digital asset space.

Factors Influencing Profitability in Futures Trading

Several factors contribute to the profitability of futures trading across different markets. Market knowledge, technical analysis skills, and a deep understanding of the specific dynamics influencing each asset class are essential. Additionally, staying informed about global economic trends, geopolitical events, and regulatory changes can help traders anticipate market movements and position themselves for profitable opportunities. Effective risk management, disciplined trading strategies, and the ability to adapt to changing market conditions further enhance the potential for profitability in futures trading.

Risk Management Strategies for Profitable Futures Trading

While the potential for profitability in futures trading is evident, it is crucial for traders to prioritize risk management to protect capital and mitigate potential losses. Implementing risk management strategies, such as setting stop-loss orders, diversifying positions, and managing leverage effectively, is essential. Traders should establish clear risk tolerance levels and adhere to disciplined risk management practices to navigate the inherent volatility of futures markets. By prioritizing risk management, traders can safeguard their capital and position themselves for sustainable profitability over the long term.

Using Technical Analysis and Trading Indicators

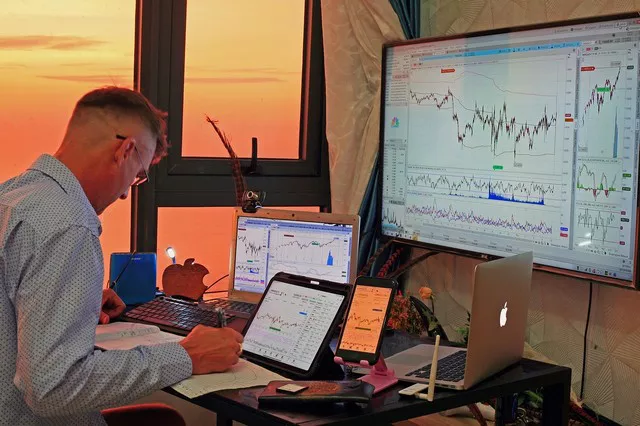

Technical analysis plays a significant role in identifying profitable opportunities in futures trading. Traders often utilize a variety of technical indicators, chart patterns, and trend analysis to inform their trading decisions. Understanding support and resistance levels, interpreting candlestick patterns, and employing technical indicators like moving averages and oscillators can help traders identify potential entry and exit points. Technical analysis serves as a valuable tool for assessing market sentiment and making informed trading decisions in pursuit of profitability.

Market Timing and Entry Points

Successful futures trading requires strategic market timing and effective entry points. Traders may use a combination of fundamental analysis and technical analysis to identify optimal entry levels. Monitoring economic calendars, earnings reports, and key announcements can provide insights into potential market-moving events. Additionally, understanding market sentiment and trend dynamics can assist traders in selecting opportune moments to enter positions. Mastering the art of market timing enhances the probability of capturing profitable moves in futures trading.

Adapting to Changing Market Conditions

The ability to adapt to changing market conditions is a hallmark of successful futures traders. Markets are dynamic and influenced by a myriad of factors, including economic data releases, geopolitical developments, and unforeseen events. Traders who stay informed, remain flexible in their strategies, and adjust to evolving market dynamics are better positioned to capitalize on profitable opportunities. Adapting to changing conditions requires continuous learning, staying abreast of market trends, and being prepared to reassess and adjust trading strategies as needed.

Continuous Learning and Improvement

Continuous learning is a key component of sustained profitability in futures trading. Markets evolve, and new developments impact trading dynamics. Traders should invest time in staying informed about emerging trends, technologies, and market structures. Engaging in ongoing education, attending seminars, and networking with experienced traders can provide valuable insights and contribute to continuous improvement. Traders who embrace a growth mindset and commit to lifelong learning are better equipped to navigate the complexities of futures trading and uncover new avenues for profitability.

Conclusion

In conclusion, profitable opportunities abound in the diverse landscape of futures trading. Energy futures, agricultural futures, precious metals futures, currency futures, index futures, interest rate futures, and cryptocurrency futures each offer unique avenues for traders and investors. Success in futures trading requires a combination of market knowledge, technical analysis skills, effective risk management, and the ability to adapt to changing conditions. By staying informed, employing disciplined strategies, and prioritizing continuous learning, traders can navigate the dynamic world of futures trading and position themselves for profitability. Whether in traditional commodities or the emerging digital frontier, mastering the art of futures trading opens doors to a realm of potential profits for those with the knowledge, skill, and resilience to navigate the markets successfully.